ZenithBridge Capital Family Office offers more than just wealth management. We are dedicated to preserving and growing family wealth for both present and future generations. Our approach combines proprietary mathematical models, backed by data science, to achieve targeted wealth growth. Once the desired growth is attained, we ensure a structured and seamless transfer of wealth to future generations, safeguarding the legacy and financial security of the family for years to come.

ZenithBridge Capital’s Multi Family Office (MFO) Platform is ideally suited for families with managed wealth of $10 million and above. Acting as the Family CFO, we help consolidate and manage the family’s private wealth under a single, professional management umbrella. As a true MFO, we operate independently with no proprietary funds, allowing us to offer tailored, objective advice on the best asset allocation strategies that align with each family’s financial goals and risk tolerance.

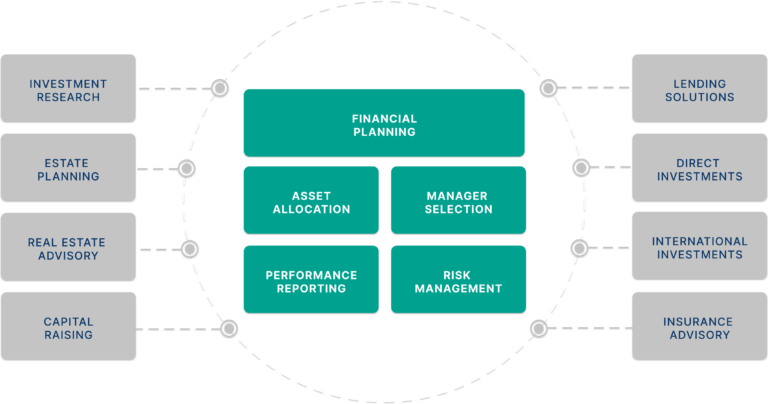

Our independence also enables us to select top-tier asset managers and investment strategies, ensuring that our private clients receive the highest quality of service according to their unique mandates. The need for a Family Office becomes increasingly important when multiple wealth managers handle substantial private wealth for a family. This can create complexities that demand a dedicated platform capable of providing holistic, unbiased advice, continuous risk management, consolidated reporting, asset administration, and performance tracking across all wealth managers.

At ZenithBridge Capital’s Family Office, we provide a comprehensive suite of extended support services designed to meet these needs, ensuring that your family’s wealth is managed with the utmost care and professionalism.

Practice Areas

At ZenithBridge Capital, we are committed to offering a comprehensive suite of complementary services, all tailored to create and maintain efficient portfolios for our clients across different market conditions. Our approach focuses on understanding the unique financial goals and risk profiles of each client, enabling us to deliver personalized investment strategies that perform consistently, regardless of market fluctuations.